22+ Market risk calculator

The calculator is built primarily for the stock market and helps you buy or sell any stock ETF or mutual fund and control your maximum risk per position. Less than 3 years 3-5 years 6-10 years 11 years or more Next Q2.

2

Skip to Content.

. Its a user friendly tool by which an individual by filling up all the details will get to know as to what amount of. If the likelihood of a particular event is rare and the consequences negligible then the risk is subsequently low. Some might be more comfortable with market-related risk while others prefer.

Use the risk assessment calculator to determine your current balance with risk. I plan to begin withdrawing money from my investments in. Skip to Content.

Risk Probability x Consequence. Trade stocks bonds options ETFs and mutual funds all in one easy-to-manage account. For shares the word market can be connoted as a whole stock index.

Ad Were all about helping you get more from your money. The FX Risk Calculator calculates the size of your position in both units and standard lots ie. In finance the CAPM model Capital Asset Pricing Model describes the relationship between the systematic risk and the expected return of the assets.

Thursday 020622 Friday 030622 Sunday 120622 Monday 130622. Past market performance is. 1 how close a relative 2 age of a relative 3 number of affected family.

The risk reward calculator was inspired by a video Spartan Trading posted on YouTube. The markets risk premium is the average market return less the risk-free rate. Quiz Calculate your Risk Appetite Q1.

Risk Reward Calculator and Simulation Inspiration. Market Cipher advanced instruments for traders analysts and brokers as well as a supportive community helping users to share ideas self-educate and generate results from anywhere. Some might be more comfortable with market-related risk while others.

On the other hand if the probability. It works with all major. It can be useful to help traders.

100000 enabling you to quickly but accurately manage your risk. Lets get started today. Watch the video below if youre interested in.

The right position size. Beta in the CAPM model is. The amount of additional risk relative increase in risk conferred from a family member to a patient depends on.

Once I begin withdrawing. This calculator is helpful to both the retired as well as non-retired people. Set your ideal no market risk percentage with Midland Nationals risk calculator.

Trading involves inherent risks including the loss of your Investment capital or even beyond that. With the Risk Calculator you can estimate your Health Ratio by simulating changes to an accounts token deposits borrows perp positions and pricing. Results are not guaranteed and may vary from person to person.

Market Risk Premium. WEALTH WORLD FINANCIAL MARKET RESEARCH LTD has been successfully registered as a legal entity identifier and is a confirmed legal entity registered in Mauritius. Risk Calculator will help you manage risk effectively by calculating your trade lots ie.

Virtual College Resources Columbus State Community College

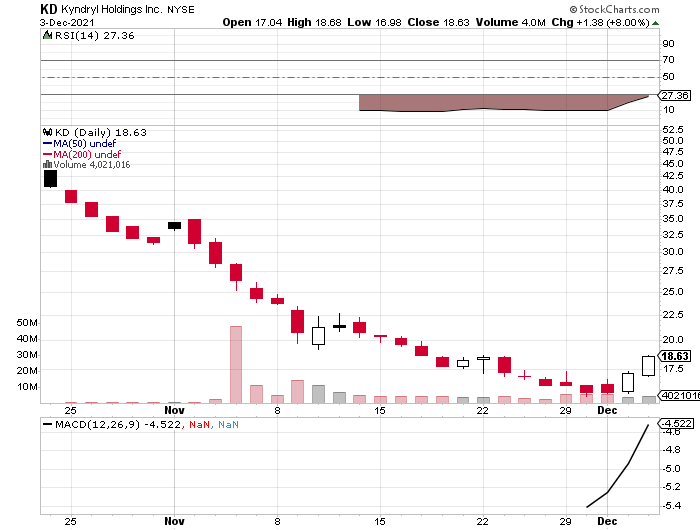

Ibm Spinoff Kyndryl Is The Worst Of The Worst Buy It Nyse Kd Seeking Alpha

Connecting My Dropbox Account Cognizer

22 Sample Startup Budgets In Pdf Ms Word Excel

Disaster Recovery Plan Template Nist Unique Itil Disaster Recovery Plan Template S And Business Plan Template How To Plan Templates

22 Sample Startup Budgets In Pdf Ms Word Excel

Cost Of Automation Versus Manual Labor Dynamic Design Solutions Case Studies

![]()

Premium Psd Money Coin Vault 3d Icon Blue Color Money Vault Symbol Finance Icon 3d Rendered Illustration

Platform Cognizer

References Plat4mation

Sample High Level Business Plan Pertaining To High Level Business Plan Template Business Plan Template Business Planning How To Plan

Resources Genesys

Fr3 Fluid Solar Power Cargill

Synology 2022 Nas Hardware Confirmed Releases Our Predictions Nas Compares

Iata Passenger Demand Recovery Continued In 2021 But Omicron Having Impact

Financial Aid Allowance Columbus State Community College

Investigation Of Stochastic Unit Commitment To Enable Advanced Flexibility Measures For High Shares Of Solar Pv Sciencedirect